E-tax payment 24/7: upgrade for implementing the pre-authorized tax payment program

Friday, July 19, 2019 10:23

The General Department of Vietnam Customs has just issued the official letter No. 4050/ TCHQ-TXNK, dated June 19,2019 on implementing the program that authorizes customs authorities to debit their accounts to pay taxes from September 15, 2019 . This is the next reform step of the customs sector to help enterprises quickly clear goods and carry out extensive cross-sector reforms to reach the ASEAN 4 level of export and import facilitation, as guided by the Government.

According to the General Department of Vietnam Customs, the e-tax payment 24/7 will be upgraded and expanded to deploy the pre-authorized tax payment program. So that, right after taxable declarations are registered, the tax payable information will be sent to authorized banks to pay tax for enterprises.

The e-tax payment 24/7 was officially deployed in October 2017 to meet the requirements on administrative reform: providing the maximum favorable conditions for tax payers to pay tax at anytime, anywhere by any means; ensuring that information on tax payment is timely and accurately liquidated; reducing tax payment time, at the same time, releasing goods right after paying taxes, thereby, reducing the time for completing the Customs procedures for import and export goods by enterprises to the average level of ASEAN-4 countries under the Government’s direction.

Since the deployment of e-tax payment 24/7, the number of banks supporting enterprises in e-tax payment 24/7 is increasing, so far there are 22 banks officially deploying the e-tax payment and Customs clearance 24/7.

According to the latest statistics of Vietnam Customs, in the first 6 months of 2019, the total import-export tax revenue through e-tax payment reached VND 162,944 billion, accounting for 93% of the total revenue to the State budget of Vietnam Customs. Of which VND 13,550 billion was collected via 24/7 e-tax payment.

With the deployment of the pre-authorized tax payment, enterprises have an additional channel to pay tax including: direct payments at the bank; 24/7 e- tax payment channel or pre-authorized tax payment program. By participating in the pre-authorized tax payment, enterprise do not have to make payment order on the Customs portal or at the bank and can carry out the import and export procedures for goods at any border gate without collecting points of banks/the treasuries, without internet network.

According to the Customs Information and Statistics Department, up to now, 38 commercial banks have signed budget collection cooperation agreements with the General Department of Customs, exchanged payment information via electronic environment. However, this program will be applied to only 22 commercial banks where already implemented the e-tax payment program 24/7.

To deploy successfully, the General Department of Customs has issued decision 1737 / QD-TCHQ to amend procedures and standards of e-tax payment messages and sent a letter requesting these banks to study the procedures, the time for upgrading the system as requirements of the program and register to participate in the pre-authorize tax payment program.

Other news

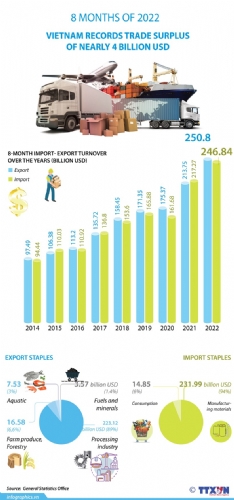

- Vietnam records trade surplus of nearly 4 billion USD in eight months(9/16/2022 10:51:43 AM)

- Vietnam reports trade surplus of nearly 4 billion USD in eight months(8/30/2022 3:55:09 PM)

- Agro-forestry-aquatic product exports rise over 13% in eight months(8/30/2022 3:50:51 PM)

- Trade surplus to hit 1 billion USD this year(8/24/2022 3:17:48 PM)

- Seafood exports expected to reach $3b in Q3(8/15/2022 9:58:47 AM)

- Vietnam eyes global top 10 in agricultural processing(8/12/2022 12:36:32 PM)

- Preliminary assessment of Vietnam international merchandise trade performance in the first half of July, 2022(8/10/2022 1:57:37 PM)

- Agro-forestry-fishery exports exceed 32 billion USD in first 7 months(8/10/2022 1:48:48 PM)

- Top five items with export earnings exceeding US$10 billion each(8/10/2022 1:41:28 PM)

- Industrial production index up 8.8% in first 7 months of 2022(8/8/2022 9:55:37 AM)