Vietnam predicted to maintain status as ASEAN’s bright spot in trade in 2019

Monday, September 23, 2019 11:10

Vietnam, along with Thailand, is predicted to remain a bright spot in ASEAN in terms of trade surplus for the remaining period of the year, according to Viet Dragon Securities Company (VDSC).

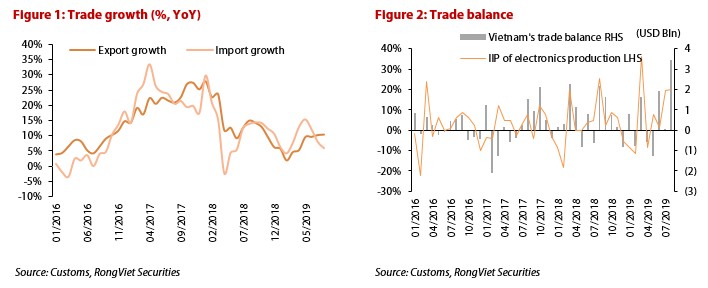

In the first eight months of 2019, Vietnam’s total trade value reached US$340 billion, up 8.9% year-on-year, leading to a trade surplus of US$5.2 billion during the period, data from General Department of Vietnam Customs (GDVC) revealed.

During this process, export growth has been recovering gradually and rose to 10.2% year-on-year in August, compared with this February’s 1.9% inter-annual rise. Electronics and accessories, plus electrical products, wood and textile made the biggest contribution to the growth.

Notably, electronics manufacturers stepped up their production starting in May. As a result, the total trade surplus surged to US$1.9 billion and US$3.4 billion in June and August, respectively.

That eased concerns about the trade deficit recorded at the beginning of the year, standing at US$170 million in the first five months. Meanwhile, import growth reversed and has dropped since June because of the decrease the volume of imported cars.

However, the notable concern is related to Vietnam’s trade balance with the US and China. Statistically, the trade surplus with the US skyrocketed to US$30 billion in the January – August period, up 40% year-on-year, while the trade deficit with China expanded to US$25.4 billion, up 46% year-on-year. The latter deficit is in part related to the fact that Vietnam has limited manufacturing capacity and must import various inputs from China.

The government is well aware of that. Vietnam’s Politburo, the country’s most powerful decision-making body, issued a resolution to keep attracting FDI. Meanwhile, the Ministry of Industry and Trade has issued a draft circular on Vietnamese goods’ origins.

Another notable movement is that the VND remains stable against the greenback although the US dollar Index (DXY), measuring the value of US dollar relative to a basket of foreign currencies, stayed at high levels. The VND is supported by a healthy trade surplus, all-time high FX reserve and stable economic growth. The currency has started slipping down by 0.35% in the last 15 days after State Bank of Vietnam’s decision on lowering its policy rates.

The USD/VND exchange rate rose by 0.3% year-to-date. From VDSC’s point of view, the increase is enough to keep Vietnamese goods competitive and economic growth stable.

Hai Yen

Other news

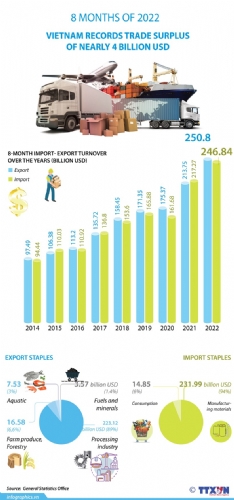

- Vietnam records trade surplus of nearly 4 billion USD in eight months(9/16/2022 10:51:43 AM)

- Vietnam reports trade surplus of nearly 4 billion USD in eight months(8/30/2022 3:55:09 PM)

- Agro-forestry-aquatic product exports rise over 13% in eight months(8/30/2022 3:50:51 PM)

- Trade surplus to hit 1 billion USD this year(8/24/2022 3:17:48 PM)

- Seafood exports expected to reach $3b in Q3(8/15/2022 9:58:47 AM)

- Vietnam eyes global top 10 in agricultural processing(8/12/2022 12:36:32 PM)

- Preliminary assessment of Vietnam international merchandise trade performance in the first half of July, 2022(8/10/2022 1:57:37 PM)

- Agro-forestry-fishery exports exceed 32 billion USD in first 7 months(8/10/2022 1:48:48 PM)

- Top five items with export earnings exceeding US$10 billion each(8/10/2022 1:41:28 PM)

- Industrial production index up 8.8% in first 7 months of 2022(8/8/2022 9:55:37 AM)